Conventional loan calculator how much can i borrow

For a conventional loan your loan must fall within the loan limits set by Fannie Mae and. Its Never Been A More Affordable Time To Open A Mortgage.

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Use the Tab key to move to Periods.

. You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property. Ad Best Home Loan Mortgage Rates. To illustrate think about a 50000 five-year loan.

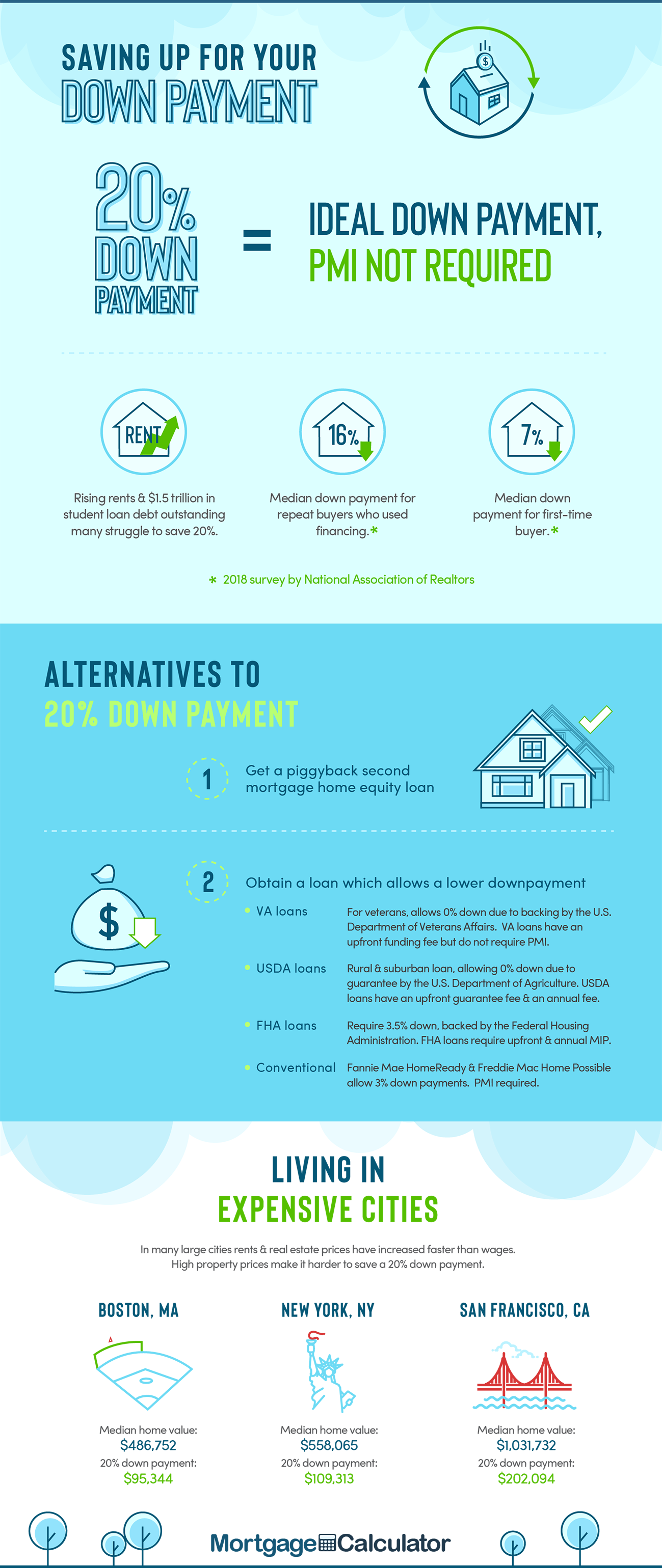

The more you put toward a down payment the lower your LTV. Fill in the entry fields. Compare Offers Apply.

Comparing USDA Loans Conventional. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Trusted VA Loan Lender of 300000 Veterans Nationwide.

To calculate this multiply your homes. Set it to 48 Set the Frequency to Monthly The End. The maximum allowable term is six years.

This ratio compares the amount you hope to borrow with how much the property is worth. What is the maximum amount you can borrow on a conventional loan. Want to Speak with us.

With a 6 interest rate your monthly payment would be 96664 for a total cost of 5799840. Ad Borrow The Amount You Need All At Once With Funds Available As Soon As The Next Day. Loan to Value LTV Calculator.

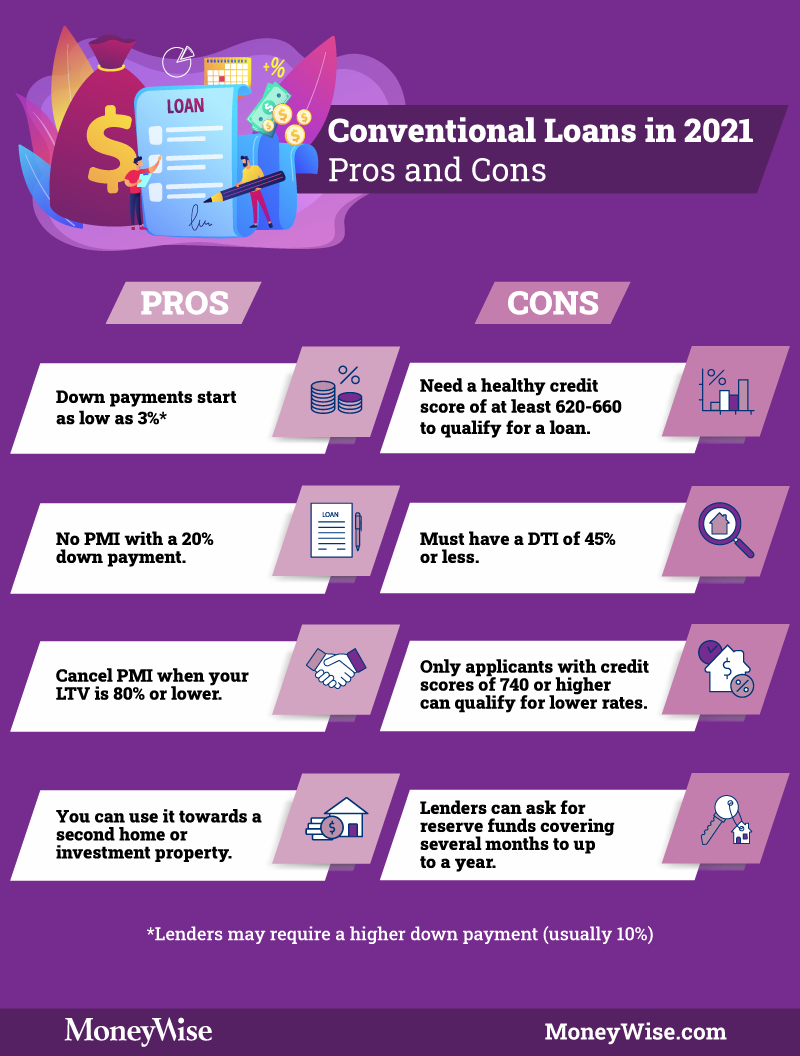

Conventional fixed-rate loans are available with a down payment as low as 3. To calculate your LTV. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Bank Offers Conventional Loans With Fixed Rates Low Down Payment Options. This tells the calculator that the regular payment will be 45000 a month until the loan is paid off. But ultimately its down to the individual lender to decide.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Once you input your monthly obligations and income the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment and total mortgage amount that you can. Find A Great Lender Today.

Use our free mortgage calculator to determine how much house you can buy and what youll be approved for. See How Much You Can Save with Low Money Down Low Interest Rates. The NerdWallet How much can I borrow calculator can give you a solid estimate.

Refinance Refinancing FHA to Conventional Loan View Learning Center. Ad Prequalify Online Today And See How Much You May Be Able To Borrow. This ratio says that your monthly mortgage costs should be no more than 36 of your gross monthly income and your total monthly debt should be no more than 43 of your.

Lenders can approve microloans for as much as 50000 though the average of these loans is no more than 15000. Lenders typically require that you have between 15 percent and 20 percent equity in your home. Loan-to-value LTV ratio.

Loan calculator Our calculator can help you work out what your monthly repayments could be based on what you want to borrow. The first step in buying a house is determining your budget. The loan to value or LTV of your mortgage means how much the mortgage is in.

Calculate your payment now using. Keep in mind that with a low down payment mortgage insurance will be required which increases the cost of the. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

Get Pre-Qualified in Seconds. 800 335-3009 760 779-8724. Unbeatable Mortgage Rates for 2022.

Calculate Your Rate in 2 Mins Online. This mortgage calculator will show how much you can afford. Calculate what you can afford and more.

Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. For conventional loans the front end-DTI limit is 28 while the back-end DTI is 43 but this can be as high as 50 if you have compensating factors. With a 12 interest rate.

With a construction-to-permanent loan you borrow money to pay for the cost of building your home and once the house is complete and you move in the loan is converted to a. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future. With A TD Fit Loan You Dont Need To Use Your Home Or Other Assets To Borrow.

Real Estate Equipment Loan. As part of an.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Chip Reverse Mortgage Rates Homeequity Bank

What Is A Conventional Loan 2021 Rates And Requirements

Types Of Mortgage Loans

Conventional Loan Requirements And Guidelines Credible

1

What Is Mortgage Insurance We Ve Got The Answers On Our Blog Mortgage Mortgage Tips Private Mortgage Insurance

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Mortgage Loans

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

1

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Conventional Vs Fha Loan Sprint Funding

1

Conventional Loan Requirements Moneygeek Com

Home Loan Downpayment Calculator